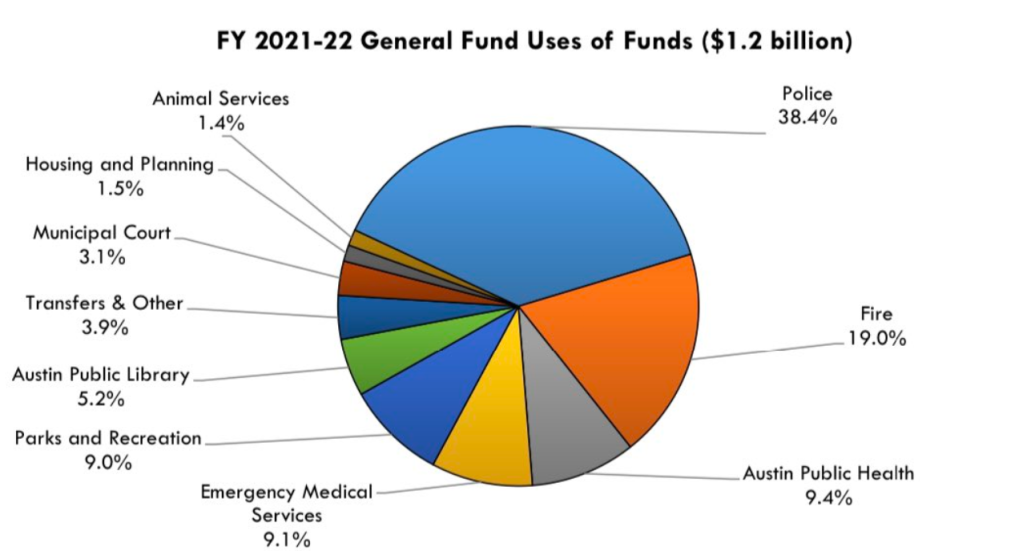

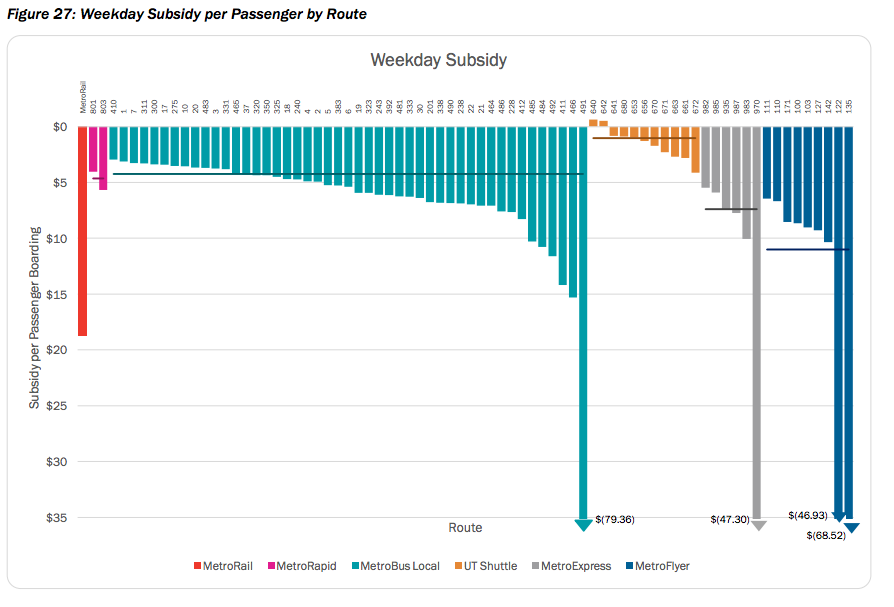

This November’s police staffing measure will cost more than official estimates.

This November’s police staffing measure will cost more than official estimates.

The Austin Strategic Mobility Plan should be the focus of next year’s City transportation bond, not (necessarily) Project Connect.

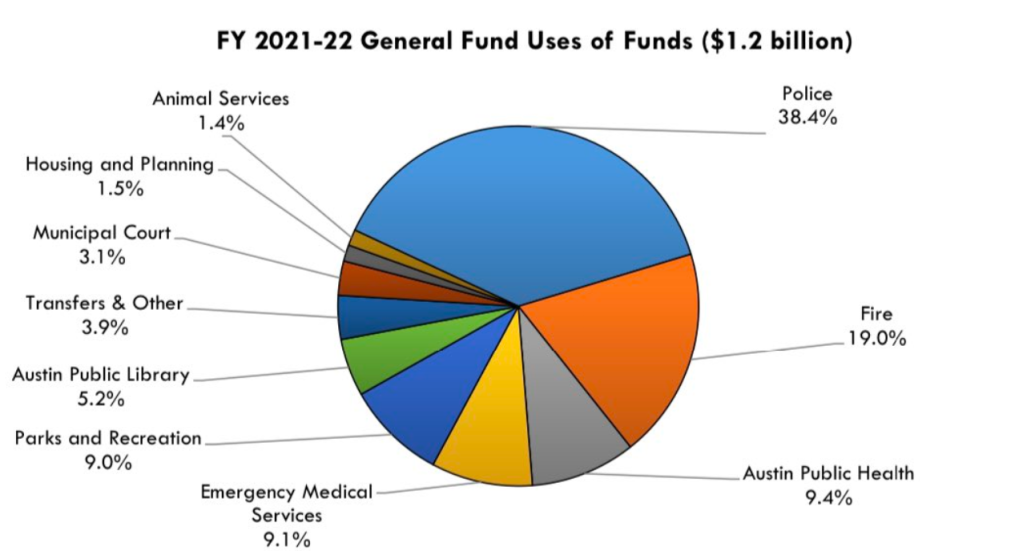

Existing and envisioned mode share from the adopted Austin Strategic Mobility Plan

A simple arithmetic error threatens the durability of Austin’s new land development code.

Council Member Casar endorsing a 3x housing capacity multiplier

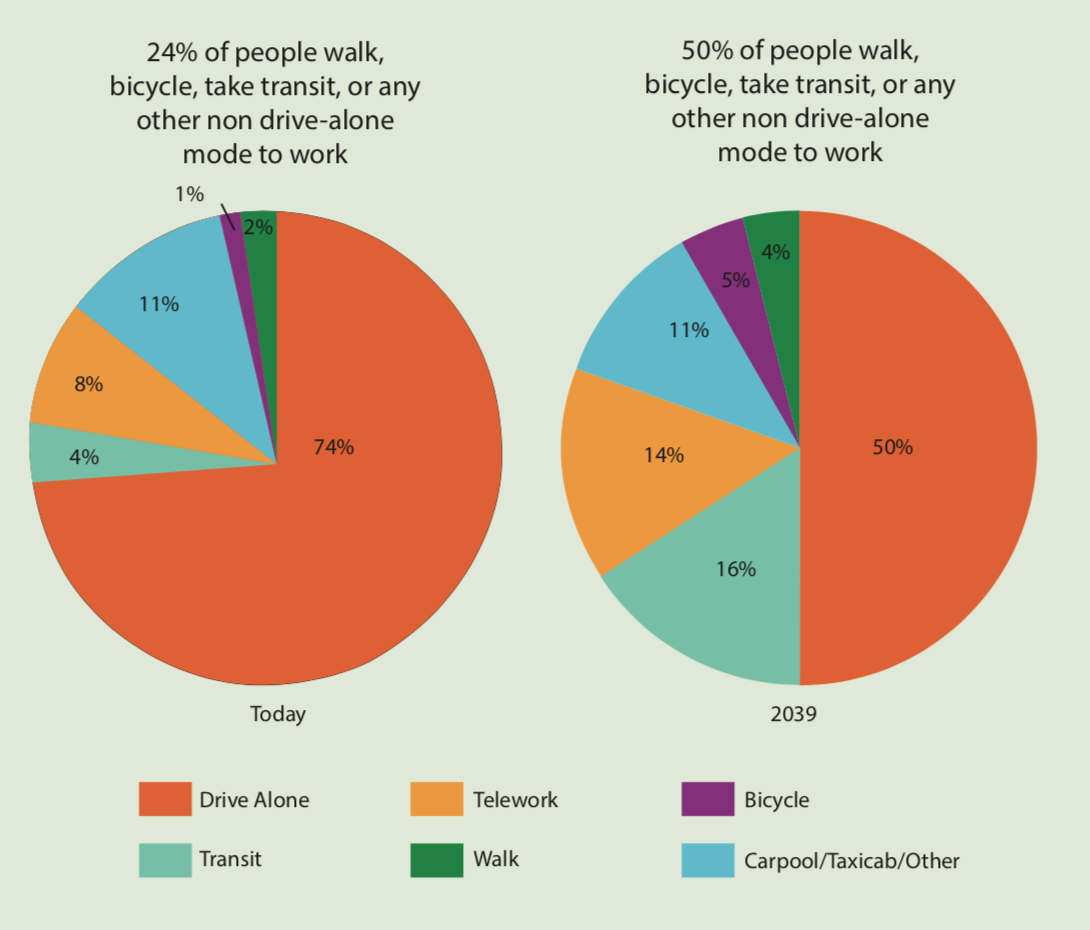

Achieving a 50% sustainable commute mode share requires a boost in local transit operating funding sources and a focus on productivity-enhancing transit capital projects.

A system-wide route productivity summary, courtesy of the Connections 2025 plan.

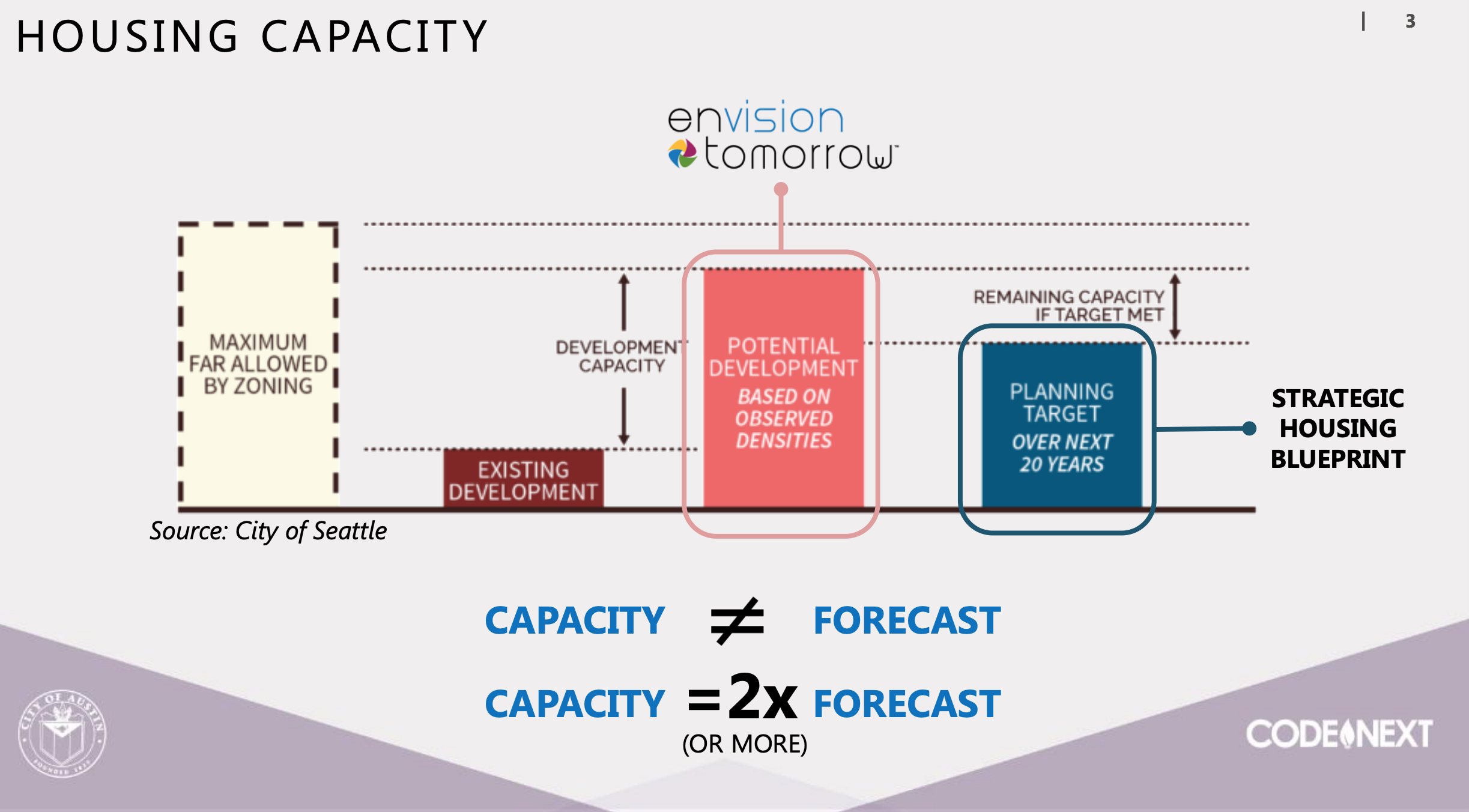

Without a validated housing capacity model, land development code reforms might not add up to what we think they will.

A presentation slide from Fregonese Associates highlighting their model’s approach to defining potential housing development

In the wake of an obvious mapping error, the CapMetro CEO dodges requests for data transparency and a public version control system.

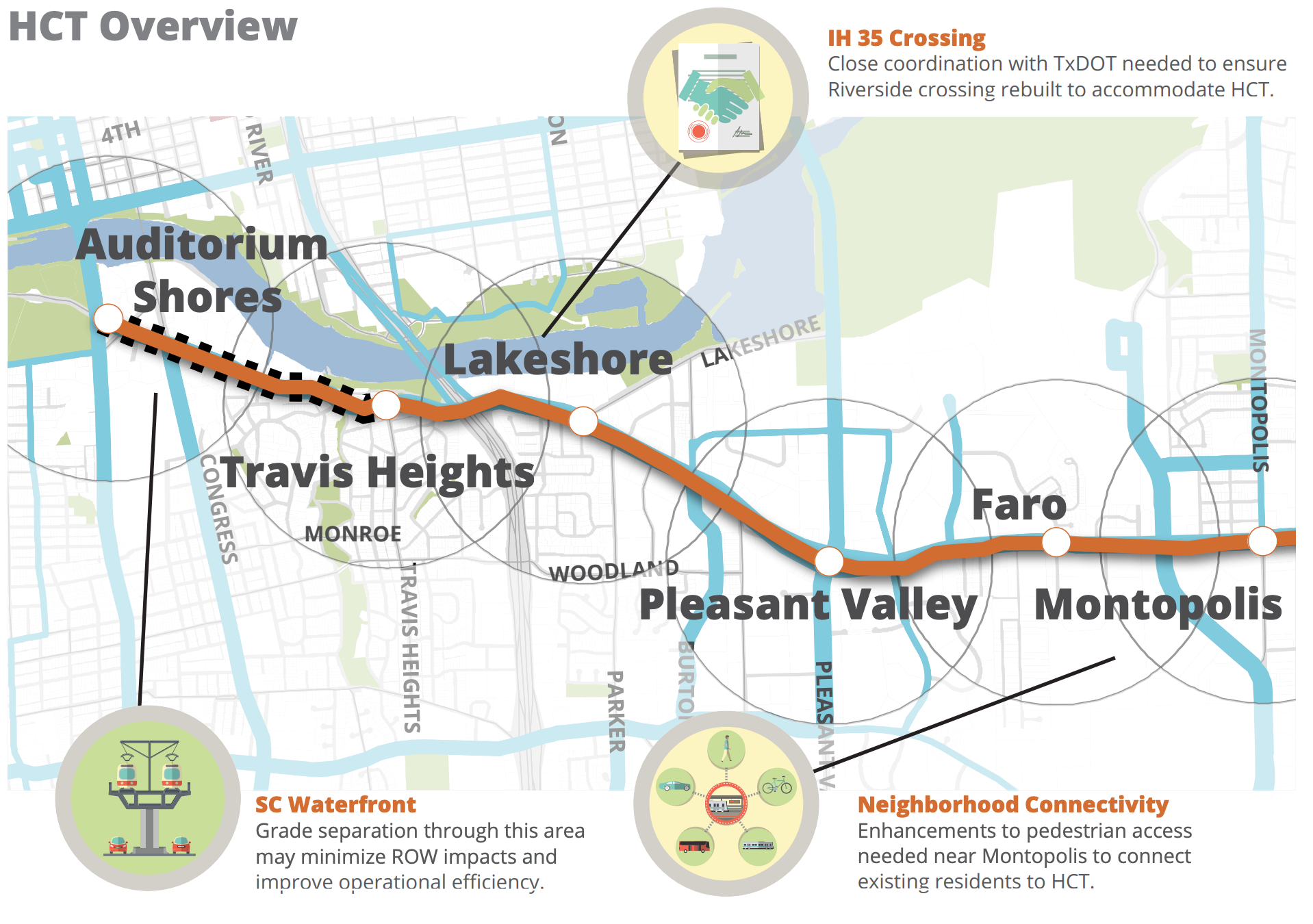

An overview of the East Riverside corridor, according to the latest Project Connect “flipbook”

An overview of the East Riverside corridor, according to the latest Project Connect “flipbook”